Investopedia defines Corporate governance as a system of relationships, defined by structures and processes. It is a set of rules, practices, and processes used to direct and control a company. It involves balancing the interests of a company’s stakeholders such as management, shareholders, suppliers, customers, financiers, government, and the community. The objective of corporate governance is to get the nearest alignment of the interests of individuals, businesses, and society (Cadbury, 2003). Good corporate governance involves a framework that is put in place to get the most value for the shareholders legally, ethically, and sustainably(Murthy, 2006). According to the Organization of Economic Cooperation and Development (OECD), it also provides the backbone through which the objectives of the company are set, and the means of attaining those objectives and monitoring performance are determined".

Corporate governance serves to safeguard and boost the interests of shareholders by setting the strategic direction of a company and appointing and monitoring capable management to achieve this. It is an essential ingredient for the success of a business. When this key governance mechanism is missing it can lead to the ineffective or total failure of a business (Walker Review,2009).

Related: The Advantages of Ethical Behaviour in Business

When does corporate governance fail?

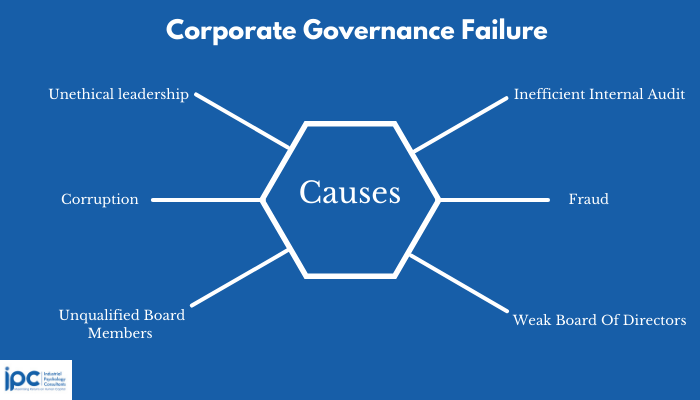

Panfilii Popa in the journal paper Failure of Corporate Governance – Intention or Negligence proffered that some of the governance issues faced by companies that inevitably lead to corporate governance failures are:

- Ineffective governance mechanisms, for example, lack of board committees

- Non-independent board and audit committee members

- Intentional misleading of the Board by management to protect themselves after evading and bypassing internal controls

- Underqualified board members

- Ignorance by regulators, auditors, analysts of the financial results, and red flags.

- Management who exhibit ineptitude

- Dereliction of the procedures stipulated in internal regulations

- Insufficient attention paid to risk management

- Inconsistent distribution of duties and responsibilities

- The inefficiency of internal audit

- Influencing the external auditors to express an audit opinion inconsistent with reality.

- Poor ethical leadership

- lack of integrity

- fraud

- Corruption

Related: Ethics and Human Resource Management

What are the effects of corporate governance failure?

Advertisment

Loss of Shareholder Confidence and Trust

When a company deviates from its corporate governance strategy it sends a signal to its shareholders that it cannot be trusted. This erodes any confidence that the shareholders had in the business and leads them to feel cheated or misled. If shareholders believe bad business decisions are in the company's immediate future, they may jump ship to avoid any potential loss.

Difficulty Raising Capital

A lack of adherence to a company’s corporate governance strategies can also scare away investors. For investors, one of the most important aspects when making an investment decision is the level of implementation of corporate governance principles (public disclosure of information, protection of shareholder rights, and equal treatment of shareholders) and profitability, which ensures return on their investment.

Related: Span of control: Everything you need to know

No-Risk Management

Not conforming to its corporate governance strategies may lead to a lack of risk management within a business. This increases the possibility of the company making bad investments and decisions.

Increased Government Oversight

A company with a reputation for lack of adherence to corporate governance strategies may incur increased government oversight from departments looking to verify that the company is operating within the bounds of the law. This puts the business in the spotlight if anything was to ever go wrong.

Related: Knowledge, Skills and Abilities: Everything you need to know

These issues may, however, be overcome by:

Increasing Diversity

In 2008, the board composition of Fortune 100 companies was approximately 71 percent white men and 29 percent women and minorities. Women make up only 16 percent of the directors of Fortune 500 companies. Diversity in the boardroom is known to improve company performance.

Appointing Competent Board Members

Adequate time must be devoted to identifying board members who have the skills and industry knowledge to assist the board. There needs to be an understanding of what skills it has and those skills it requires. A prospective board member should also be evaluated on his or her interpersonal skills as this relates to overall board performance.

Related: The ADKAR model of change: The ultimate guide to leading organisational change

Evaluating Board Performance

Boards must be willing to examine their strengths and weaknesses. Self-Evaluation should be done routinely as well as performance reviews for individual directors. The evaluation process should be used to identify weaknesses in board performance and adopt reforms needed to improve board performance. The evaluation should be broad, cut across all issues and personnel, and include senior management interactions with board members.

Prioritizing Risk Management

Every board should establish an effective system for risk oversight and management. This effective risk management leads to better decision-making and accurate cost-benefit or risk-reward decisions which is always in the best interest of the company (Michael Volkov, 2014).

Related: 4 Pillars of Corporate Governance

External Audit

Companies should invest in external auditing as internal auditing may be biased and issues may be swept under the carpet. They should also accept excuses and bias the results of the external audit. They should work to address the issues raised rather than ignore them.

Put simply just conforming to the corporate governance strategies already in place will be best for the company.

Conclusion

Bad corporate governance could cripple even the best businesses. A systemic failure of corporate governance means the failure of the whole set of regulatory, market, stakeholder, and internal governance. Businesses need to ensure they remain disciplined, transparent, independent, accountable for their actions, responsible, and fair. In the absence of effective governance, companies will no doubt feel the consequences either financially, legally, or incur reputational harm. Good corporate governance plays a key role in enhancing the integrity and efficiency of companies, as well as the financial markets in which the company operates. Poor corporate governance weakens a company's potential and can open the way for financial difficulties and fraud.

In brevity, it takes a good and strong board of directors to ensure that good corporate governance practices are followed. For further reading, you can check the quick wins for every new board of directors.